So, you’ve decided you’re ready to buy your first home. Congratulations—you’re about to enter the world of open inspections, real estate agents who say “this one won’t last long,” and property prices that make your bank account cry.

Here’s the kicker: saving the deposit is often harder than paying the actual mortgage. Thanks to soaring property prices in Australia, a 20% deposit can feel like trying to scale the Sydney Harbour Bridge in thongs.

This guide lays out practical, no-nonsense first home buyer finance tips to help you actually afford that elusive deposit. No fluff, no miracle hacks—just strategies that real buyers use to get into the market (without surviving on two-minute noodles for a decade).

Snapshot Summary: Key Takeaways

-

Deposits are the main hurdle: For most first home buyers, it’s not loan approval, it’s saving enough upfront.

-

You don’t always need 20%: But anything less means extra costs (like LMI).

-

Government schemes can help: First Home Super Saver, First Home Guarantee, and state concessions exist—but eligibility is strict.

-

Budgeting smarter matters: Small daily savings won’t cut it; you need big-picture financial planning.

-

Rentvesting is a sneaky option: Renting where you want to live while buying somewhere you can afford.

Want the full playbook on how to stop dreaming and start owning? Keep scrolling.

Section 1: How Much Do You Really Need for a Deposit?

The golden rule you hear everywhere: 20%.

-

Sydney median house price 2025: $1.3m → Deposit = $260,000.

-

Melbourne median: ~$940,000 → Deposit = $188,000.

-

Regional cities: still pricey, but more forgiving.

But here’s the good news: you don’t always need the full 20%.

-

Some lenders accept 10% deposits.

-

With government schemes, 5% deposits are possible.

-

The catch? You’ll pay Lenders Mortgage Insurance (LMI) if under 20%.

Pro Tip: Aim for 15% minimum. It reduces your LMI costs and makes lenders take you more seriously.

Section 2: First Home Buyer Finance Tips That Actually Work

1. Automate Your Savings

Treat saving like a bill. Schedule automatic transfers into a dedicated savings account right after payday.

2. Use a High-Interest Saver or Offset Account

Even a slightly higher interest rate means thousands more over a few years.

3. Cut the Big Costs, Not Just Coffees

Forget the “skip your daily latte” advice—it won’t save you a house. Focus on:

-

Reducing rent (share house, move further out).

-

Selling unused assets (that jet ski your mate convinced you to buy).

-

Downgrading cars or insurance policies.

4. Take Advantage of Government Schemes

-

First Home Owner Grant (FHOG)

-

First Home Super Saver Scheme (use super contributions to save deposit faster)

-

First Home Guarantee (buy with 5% deposit, no LMI)

-

State stamp duty concessions

Did You Know? In NSW, stamp duty can add more than $40,000 to your upfront costs. That’s more than most people’s cars.

Section 3: The Hidden Costs Nobody Warns You About

Buying isn’t just about the deposit. First home buyers often forget:

-

Stamp duty (unless exempt).

-

Conveyancing/legal fees: $1,000–$2,500.

-

Inspections: $500–$1,000.

-

Moving costs: Trucks, cleaners, new furniture.

-

Immediate repairs: That “cosy fixer-upper” will fix your wallet.

Quote from a mortgage broker:

“First-time buyers often scrape together just enough for the deposit but forget the 5–10% extra for fees. That’s the difference between settlement and heartbreak.”

Section 4: Quick Guide – Turning Deposit Dreams Into Reality

The Scenario:

You’re saving for a $700,000 townhouse. The 20% deposit ($140k) feels impossible.

Common Challenges:

-

Struggling to save while paying high rent?

-

Unsure if you should use government schemes?

-

Overwhelmed by hidden costs?

How to Fix It:

-

Leverage Super: Use the First Home Super Saver Scheme for tax advantages.

-

Rent Smarter: Consider a cheaper rental or move back with family short-term.

-

Set Clear Milestones: Save in chunks (first $50k, then $100k) to stay motivated.

-

Talk to a Broker Early: They’ll tell you what deposit size makes sense for your situation.

Why It Works:

Because breaking the “impossible” goal into achievable steps makes the whole process less terrifying—and much more realistic.

Section 5: Interactive Quiz – How Ready Are You to Buy?

Q1: How much of a deposit have you saved?

-

A) 20%+ (I’m basically a unicorn).

-

B) 10–19% (I’m close).

-

C) Less than 10% (don’t judge me).

Q2: Do you qualify for government schemes?

-

A) Yes, already checked.

-

B) Maybe, still looking.

-

C) No idea.

Q3: Have you accounted for stamp duty and fees?

-

A) Yep.

-

B) Kind of.

-

C) Wait, there are extra fees?

Results:

-

Mostly A’s: You’re nearly ready—start house hunting.

-

Mostly B’s: You’re on track, but get serious about planning.

-

Mostly C’s: Time to hit pause and build a stronger savings plan.

Section 6: Rentvesting – The Middle Ground

If you can’t afford to buy where you want to live, consider rentvesting.

-

Buy in an affordable suburb with good growth prospects.

-

Rent in the area you actually want to live.

-

Benefit: You’re on the property ladder without living in a shoebox 40km from your job.

Pro Tip: Check rental yields carefully. If the rent doesn’t cover most of the mortgage, you’ll be subsidising it heavily.

Section 7: FAQs – First Home Buyer Finance Tips

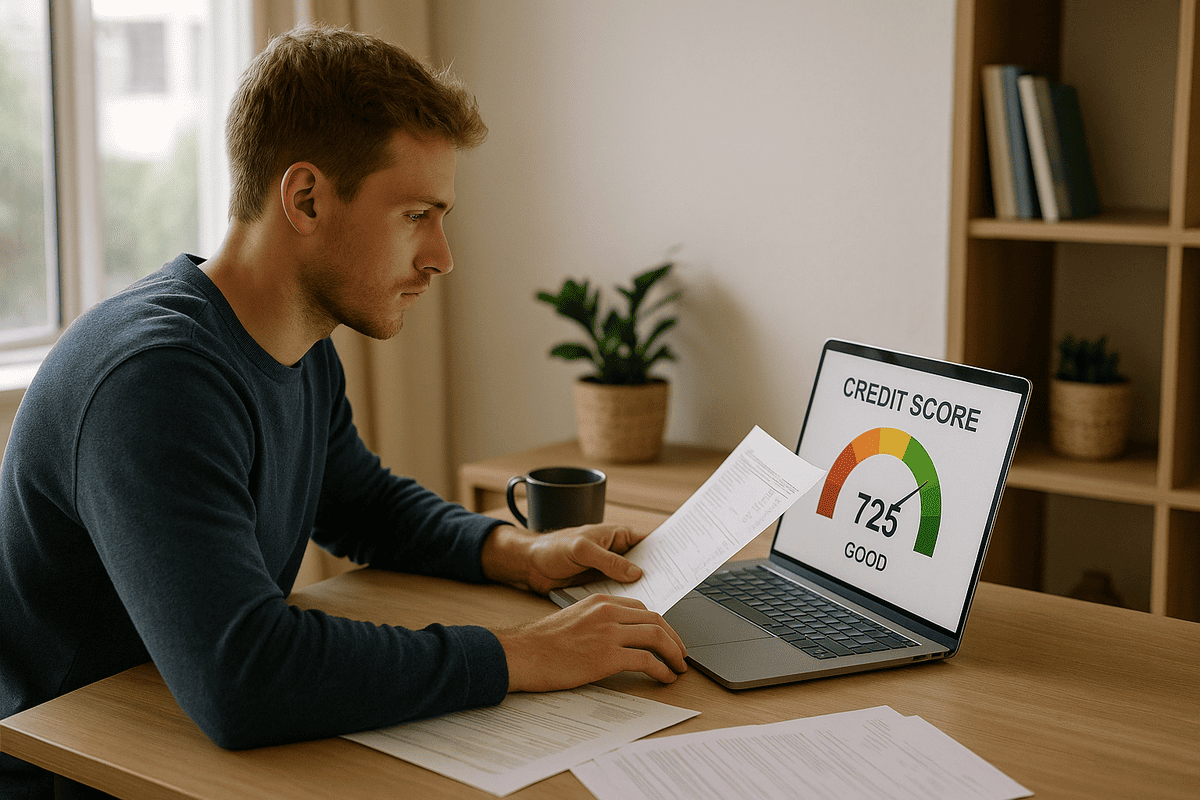

Q1: Do I really need 20% for a deposit?

Not always. 20% avoids LMI, but you can buy with 5–15% using schemes or by paying LMI.

Q2: What’s better—saving longer or buying sooner?

Depends. If prices are rising faster than you can save, buying sooner (even with LMI) can make sense.

Q3: How much should I budget for “extras”?

At least 5–10% of the purchase price for stamp duty, inspections, and legal costs.

Q4: Should I see a mortgage broker?

Yes. They’ll give you tailored advice and often find better deals than banks directly.

Q5: How long does it usually take to save a deposit?

On average, 5–10 years in major cities. But strategies like super saver schemes or rentvesting can shorten the timeline.

Conclusion

Affording your first deposit in Australia isn’t easy—let’s be honest, it’s borderline ridiculous sometimes. But with the right first home buyer finance tips, it’s doable. Automate savings, leverage government help, budget for hidden costs, and don’t be afraid of creative strategies like rentvesting.

Remember: the deposit is the biggest hurdle, but once you’re over it, you’re not just buying a home—you’re buying financial stability, independence, and a (very expensive) slice of the Aussie dream.

Disclaimer

This article provides general information only. It is not financial or legal advice. Always seek guidance from a licensed financial adviser, mortgage broker, or solicitor before making property decisions.