If you’ve felt like your pay disappears faster than a schooner at Friday knock-offs, you’re not imagining things. Between rising rents, sneaky subscriptions, and groceries that somehow cost a fortune even if you only bought bread, milk, and “just a few things,” it’s no wonder budgeting strategies feel like a moving target in Australia right now.

But here’s the good news: budgeting in 2025 doesn’t have to be a spreadsheet-driven nightmare. Forget unrealistic advice like “just skip your morning coffee” (as if that’s solving a $700k mortgage problem). Realistic budgeting is about creating a plan that fits your lifestyle, keeps you out of debt, and even leaves room for the fun stuff.

This guide unpacks practical budgeting strategies Aussies can actually use this year—no gimmicks, no guilt, just smarter ways to manage money.

Quick Overview: Budgeting Strategies at a Glance

-

Track First, Tweak Later: You can’t fix what you don’t measure.

-

Forget Perfection: Budgets should flex, not strangle.

-

Try Smarter Rules: 50/30/20 is outdated—there are better frameworks for high-cost living.

-

Automate Everything: Bills, savings, investments—set and forget.

-

Cut Waste, Not Joy: Budgeting is about priorities, not punishments.

👉 Want the full playbook? Keep reading.

Section 1: The Reality of Budgeting in Australia

Rising Costs Are Real

Housing affordability, power bills, fuel prices—none of it’s in your head. The Australian Bureau of Statistics reports inflation is still pressuring household budgets in 2025.

Money Stress Is Normal

You’re not alone if you feel strapped. Surveys show 1 in 3 Australians live paycheck to paycheck.

The Problem with Old-School Budgets

Rigid “spend nothing” rules collapse fast. Life happens—cars break down, kids need school gear, your fridge decides to retire early.

Did You Know?

The average Aussie household spends around $2,200 a week on living costs (ABS data). That’s before holidays or savings.

Section 2: Budgeting Strategies That Actually Work in 2025

1. The Zero-Based Budget

Every dollar has a job: bills, savings, fun, emergencies. Nothing left unassigned = less waste.

2. The “Pay Yourself First” Method

Automate savings before you touch your pay. If it never hits your spending account, you won’t miss it.

3. The Envelope/Category System (Digital Version)

Think of separate “pots” for groceries, bills, rent, entertainment. Easy to do with banking apps now.

4. Flexible Ratios (Beyond 50/30/20)

-

70/20/10 Rule: 70% needs, 20% savings, 10% fun.

-

60/30/10 Rule: Better for families with bigger fixed costs.

5. The “One Big Cut” Strategy

Instead of cutting 20 little things, cut one big thing. Move to a cheaper rental, refinance your mortgage, or ditch the car you barely use.

Pro Tip Box:

Don’t bother cutting $3 coffees if your $200 phone plan is the real budget-buster.

Section 3: Tools & Tech That Make Budgeting Easier

-

Budgeting Apps: Frollo, Pocketbook, or MoneyBrilliant sync with Aussie banks.

-

Round-Up Savings: Banks that round up purchases into savings accounts.

-

Spending Alerts: Notifications keep you honest.

-

Spreadsheets (If You’re Old School): Free and flexible for detail lovers.

Quote:

“Automation is the closest thing to financial discipline you don’t have to think about.”

Section 4: Common Budgeting Mistakes

-

Being too strict (and then blowing out).

-

Forgetting annual expenses (rego, Christmas).

-

Not budgeting for fun (which makes you give up).

-

Copying someone else’s system that doesn’t suit your lifestyle.

Quick Guide: Fixing a Broken Budget

Intro: Ever made a budget, stuck to it for two weeks, then watched it crash and burn? Here’s how to reset.

Common Challenges:

-

Do unexpected expenses ruin everything?

-

Are you setting unrealistic limits?

-

Do you feel guilty for spending on fun?

How to Solve It:

-

Add an Emergency Buffer: Even $20/week adds up for surprise costs.

-

Make It Flexible: Give yourself “fun money” you don’t track.

-

Review Monthly: Adjust categories, don’t abandon the whole thing.

-

Use Automation: Bills and savings leave your account before you can spend them.

Why It Works:

Because budgeting isn’t about perfection—it’s about progress.

Section 5: Interactive Quiz

“What Kind of Budgeter Are You?”

-

When payday arrives, you:

-

A) Pay bills and transfer savings first.

-

B) Spend freely and figure it out later.

-

-

Your budgeting tool is:

-

A) An app or spreadsheet.

-

B) Mental arithmetic and crossed fingers.

-

-

When your budget breaks, you:

-

A) Review and adjust.

-

B) Toss it in the bin until next year.

-

👉 Mostly A’s? You’re a smart planner. Mostly B’s? Time to rethink your strategy.

Section 6: Money Mindset and Habits

Budgeting is more than numbers—it’s psychology.

-

Separate Wants from Needs: Harder than it sounds when everything “feels essential.”

-

Delay Gratification: Wait 48 hours before buying non-essentials.

-

Avoid Lifestyle Creep: Just because you earn more doesn’t mean you need a fancier car.

Did You Know?

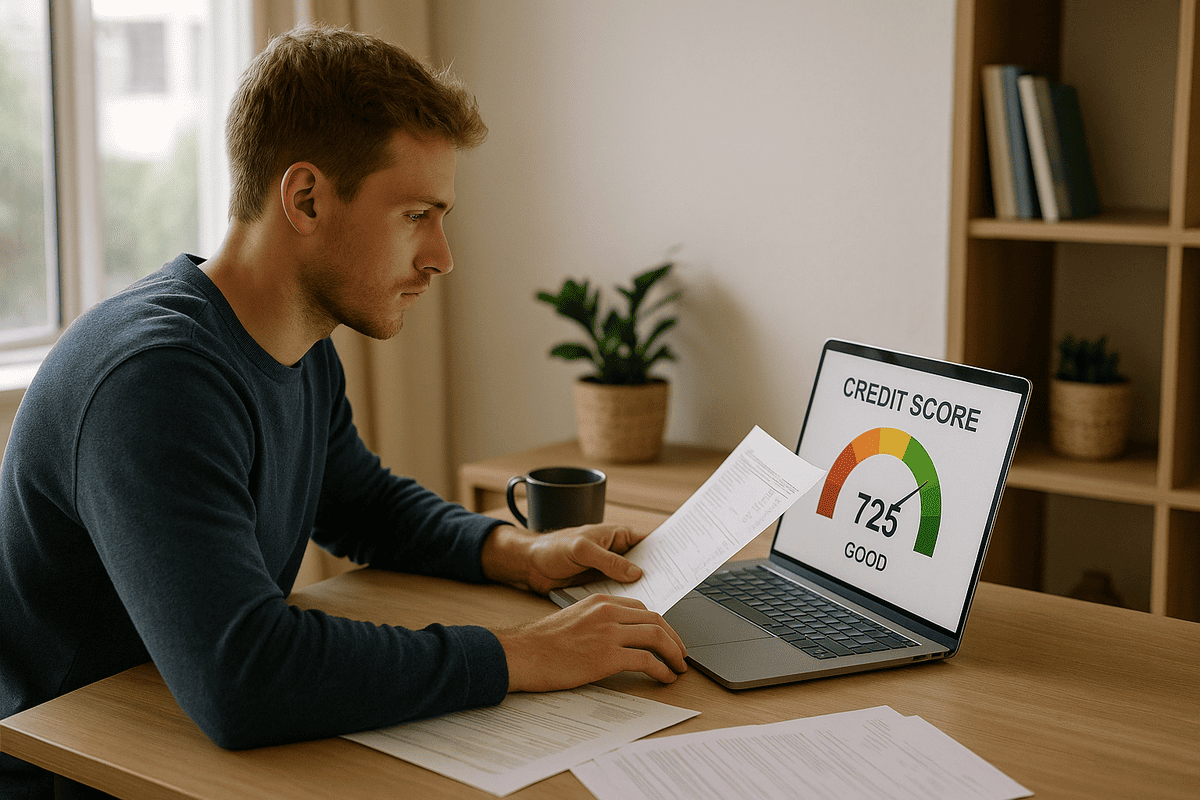

Studies show people who track spending are more likely to achieve financial goals, regardless of income.

Section 7: Budgeting for Different Life Stages

-

Young Professionals: Focus on debt, savings automation, and avoiding lifestyle creep.

-

Families: Plan for childcare, school costs, and family emergencies.

-

Retirees: Budget around fixed income, healthcare, and longevity.

Section 8: FAQs on Budgeting Strategies in Australia

Q1: What’s the best budgeting strategy in Australia right now?

There’s no one-size-fits-all. Zero-based and “pay yourself first” are popular because they suit modern lifestyles.

Q2: How do I budget if my income is irregular?

Base your budget on the lowest month’s income, then save surplus in better months.

Q3: Do budgeting apps really help?

Yes. They track and automate spending, but only work if you actually check them.

Q4: Should I budget weekly or monthly?

Weekly works well if you live paycheck-to-paycheck. Monthly suits those with stable incomes.

Q5: How much should go to savings?

Aim for 10–20% of income if possible—but any consistent amount is better than none.

Conclusion

Budgeting strategies in Australia aren’t about restriction—they’re about choice. In 2025, the smartest budgets are flexible, realistic, and supported by tech.

Whether you prefer zero-based budgeting, flexible ratios, or the “one big cut” strategy, the goal is the same: reduce money stress, save consistently, and still enjoy life.

Start small, automate where you can, and adjust regularly. Your budget isn’t a prison sentence—it’s a tool for freedom. And if you build it right, you’ll finally feel like your money is working for you, not the other way around.

Disclaimer

This article is for general informational purposes only. It does not constitute financial advice. Always consult a licensed financial adviser before making financial decisions in Australia.