We’ve all had moments where money feels like the enemy.

That sinking feeling when a bill lands earlier than expected.

Or when you swear you’ll “start budgeting next month”… but somehow next month never comes.

The truth is, being good with money isn’t about being a maths genius or never making mistakes. It’s about confidence — knowing you can handle what comes your way.

And confidence doesn’t appear overnight; it’s built one small, practical step at a time. This guide will walk you through those steps — no jargon, no guilt, and no shame.

Quick Overview — What You’ll Learn

At a glance, here’s what this article covers:

- Why “I’m bad with money” is just a story — and how to rewrite it.

- How to see where your money actually goes (without judgment).

- A spending plan that fits real life, not an accountant’s fantasy.

- How to save and invest without overwhelm.

- How to stay calm when money doesn’t go to plan.

By the end, you’ll have a simple roadmap to feeling more secure, organised, and capable — even if you’ve never felt that way before.

Step 1: Drop the “I’m Bad With Money” Label

First things first: that sentence — “I’m just not good with money” — is doing you no favours.

It’s not a fact. It’s a story you’ve repeated enough times that it feels true.

Money confidence isn’t a talent; it’s a skill. And like any skill, you can learn it with practice.

So instead of focusing on what you haven’t done, start noticing what you are doing:

- Checking your bank balance regularly.

- Paying bills on time.

- Thinking about improving your financial habits (like reading this).

Those are wins — small ones, but they count.

Mindset shift:

Change “I’m bad with money” to “I’m learning how to make money work for me.”

That one word — learning — changes everything.

Pro Tip

Language matters. Calling your plan a spending map or money flow instead of a budget can make it feel like a tool, not a restriction.

Step 2: Know Where Your Money Actually Goes

You can’t fix what you can’t see.

That’s why awareness — not budgeting — is the real first step.

Here’s a simple way to do it:

- Track for two weeks.

Don’t change anything yet. Just record every transaction. Use your phone notes, banking app, or a free money tracker.

- Sort into categories.

- Essentials: rent, bills, groceries, transport

- Lifestyle: eating out, subscriptions, shopping

- Future You: savings, investments, debt repayments

- Essentials: rent, bills, groceries, transport

- Add it up.

You’ll start to notice patterns — and they’ll tell you more than any spreadsheet could.

Maybe your “little” daily coffee is $120 a month. Or your gym membership hasn’t been used since March. That’s not failure — it’s information.

Did You Know?

The average Australian household spends over $6,000 a year on subscriptions and food delivery alone. Often, half of those charges are forgotten until someone checks their statement.

Step 3: Create a Spending Plan That Actually Works

Traditional budgets often feel like punishment — “spend less, save more, stop having fun.”

That’s why most don’t last.

Instead, let’s reframe it as a plan — a guide that reflects your values and priorities.

Try the 50/30/20 rule:

- 50% Needs: rent, utilities, groceries, transport

- 30% Wants: dinners out, hobbies, Netflix

- 20% Goals: savings, debt, investments

Don’t stress if yours doesn’t fit perfectly. If your rent eats up more than half your pay, adjust elsewhere. Flexibility is the secret to consistency.

Pro Tip

Set up two transaction accounts — one for essentials, one for spending. Once your “fun money” runs out, that’s it until next pay. No guilt, no guesswork.

Quick Wins for Real-Life Budgeting

- Automate bills so you never miss a due date.

- Rename accounts with goals like “Japan trip fund” or “Debt-free 2026.”

- Set a 24-hour rule before buying non-essentials — half will fall off the list by morning.

Step 4: Build Savings That Stick

Saving isn’t about restriction; it’s about freedom.

Freedom to say yes to opportunities, and no to stress.

But willpower alone rarely works. You need systems that make saving the default.

The 3-Account Setup

- Everyday Account — your pay lands here.

- Bills Account — set up automatic transfers for regular expenses.

- Savings/Goals Account — separate, high-interest, and ideally out of sight.

This structure makes saving automatic and keeps temptation out of reach.

Did You Know?

If you saved just $25 a week from age 25, you’d have over $40,000 by age 45 (assuming average interest). Small habits, big difference.

Mini Checklist — Save Without Stress

- Set an automatic transfer every payday

- Choose a goal (travel, deposit, emergency fund)

- Keep savings in a separate account

- Review and adjust quarterly

- Celebrate milestones — even small ones!

Pro Tip

Call your savings account something motivational. “Emergency Fund” is smart, but “Peace of Mind” or “Freedom Jar” hits the emotional goal.

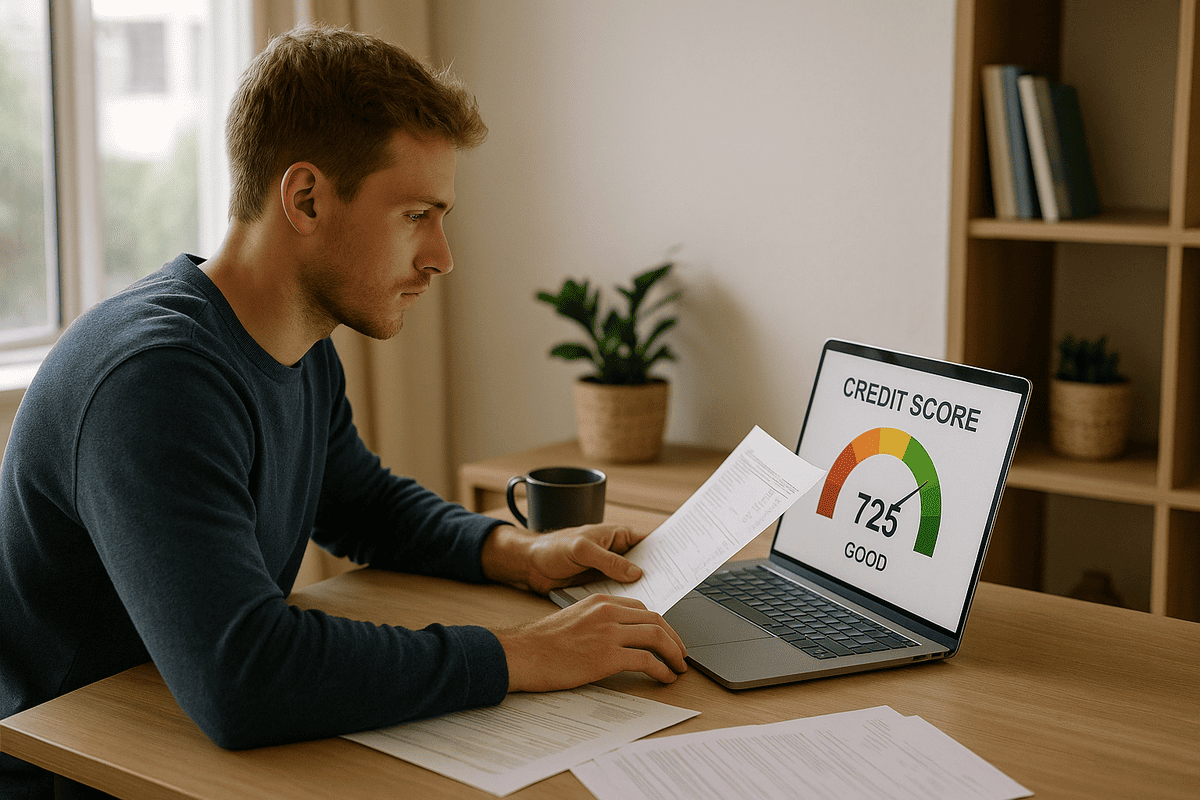

Step 5: Make Investing Less Scary

If the word “investing” makes you want to run for the hills, you’re not alone.

But investing doesn’t have to mean buying crypto or watching stock charts. It can be simple — and slow.

Start with what you already have

If you’re employed, you already are an investor through your superannuation.

Take ten minutes this week to log in and check:

- Which fund are you in?

- What are the fees?

- What’s your risk level?

That’s your first step to feeling in control.

When You’re Ready to Go Further

- Learn the basics of ETFs (exchange-traded funds) and index funds — these are broad, low-cost ways to invest.

- Start small. Some micro-investing apps let you invest spare change from daily purchases.

- Be consistent — regular small contributions matter more than timing the market.

Remember, investing isn’t gambling. It’s long-term growth — and patience is your most powerful asset.

Did You Know?

If you invested $100 a month at an average 7% annual return, you’d have $24,000 after 10 years. Even modest investments grow over time.

Pro Tip

Pay off high-interest debt before investing heavily. A 20% credit card interest rate is effectively the same as a 20% “negative return.”

Step 6: Stay Calm When Life Happens

Even with the best plans, money hiccups happen — job loss, car repairs, health bills.

Confidence comes from knowing how to respond calmly, not perfectly.

When things go sideways:

- Pause and assess. Don’t avoid your bank app — face the facts early.

- Prioritise essentials. Rent, food, transport, utilities.

- Talk to lenders early. Banks often offer hardship plans or payment pauses.

- Reach out for help. Financial counsellors offer free, confidential guidance (call 1800 007 007).

You don’t have to go through it alone — and you’re not failing. You’re adjusting.

Mini Checklist — Financial Resilience Boost

- Keep an emergency fund (even $500 helps)

- Review insurance annually

- Know your hardship support options

- Update your budget when income changes

- Keep perspective — this is temporary

FAQs

1. How much should I save each week?

Start where you are. Even $10 a week is progress. The goal isn’t perfection — it’s building a consistent habit you can sustain.

2. Should I pay off debt or save first?

If your debt has high interest (like credit cards), focus there first. For lower-interest loans, do both — a little repayment, a little saving.

3. What’s the best way to stop overspending?

Try the “24-hour rule” for non-essentials. If you still want it the next day, buy it guilt-free. Often, you’ll realise it wasn’t that important.

4. How do I pick the right investment?

Start with education. Read or watch beginner content about index funds and ETFs. Avoid anyone promising quick returns. Slow and steady wins this race.

5. How do I get back on track after a setback?

Start small. Pick one action — like tracking spending or setting an automatic transfer — and do that for two weeks. Then add another. Momentum builds confidence.

Bringing It All Together

Building financial confidence isn’t about memorising tax codes or becoming an investment guru.

It’s about trust — trust in your ability to make smart, steady decisions.

Start with one small thing: checking your accounts, setting an automatic transfer, or reviewing your super.

Then another. And another.

Before long, you’ll realise you’re not “bad with money” — you’re just someone who needed the right plan and a little encouragement.

And that’s exactly what this is.

Final Thought

Money doesn’t have to be a source of stress.

It can be a source of stability, choice, and peace of mind — when you approach it with confidence and kindness toward yourself.

You don’t have to overhaul your finances overnight. You just have to begin — today.

Disclaimer: This article provides general information only and is not intended as financial advice. Always consider your personal circumstances and seek professional guidance before making financial decisions.