Let’s be real—saving money fast in Australia can feel like trying to keep your Macca’s chips from disappearing when your mate says “just one.” Between rising rents, power bills that look scarier than a horror movie, and the sneaky subscription services draining your account each month, saving cash feels impossible.

But here’s the good news: it is possible to stash away money quickly—without surviving solely on two-minute noodles or giving up your morning flat white (unless you really want to).

In this guide, we’ll break down practical and doable strategies on how to save money fast in Australia. From easy daily hacks to bigger financial wins, you’ll find tips that actually work for real life.

Quick Snapshot: How to Save Money Fast in Australia

If you’re in a rush, here’s the cheat sheet:

-

Cut non-essential subscriptions (looking at you, five different streaming services).

-

Meal prep like a pro—your future self will thank you.

-

Switch energy providers and bank accounts for instant savings.

-

Use cashback and discount apps when shopping.

-

Sell unused stuff online (because who really needs three air fryers?).

-

Negotiate bills—yes, you can haggle in Australia.

-

Set up an automatic transfer to savings every payday.

👉 Want the full breakdown? Keep reading—you’ll be surprised how quickly these add up.

1. The Coffee vs. Home Brew Debate ☕

Yes, the “skip the latte” tip is old news, but let’s crunch the numbers Aussie-style. A daily $6 flat white = $42 per week = over $2,000 per year. That’s a holiday in Bali or a decent dent in your credit card.

Solution? Invest in a good home espresso machine (or even a $20 plunger from Kmart). You’ll save heaps and become the office barista legend.

2. The Subscription Clean-Out 📺

Netflix, Stan, Disney+, Prime, Binge, Kayo… at this point, you could be spending more on streaming than on actual internet.

👉 Do a “subscription audit”:

-

List every subscription you’re paying for.

-

Ask: Am I actually using this?

-

Keep one or two, pause or cancel the rest.

Savings: $20–$80/month = $240–$960/year. Not bad for pressing a “cancel” button.

3. Shop Smart, Not Hungry 🛒

If you’ve ever gone into Woolies “just for milk” and come out with $80 worth of snacks, you know the pain.

Pro Tip:

-

Never shop hungry (it’s dangerous).

-

Try Aldi—most items are cheaper and surprisingly decent.

-

Use rewards cards (Woolworths Everyday Rewards, Flybuys) for discounts and freebies.

Humour bonus: Aldi’s middle aisle may tempt you with a kayak or chainsaw—resist, unless you really need one.

4. Meal Prep = Money Prep 🍲

Takeaway adds up fast—$20 here, $15 there. Meal prepping is the secret weapon for saving money fast in Australia.

-

Cook in bulk (curries, pasta bakes, stir fries).

-

Freeze extras for lazy nights.

-

Pack lunch instead of buying it.

Savings: $50–$100/week. That’s $2,600–$5,200/year. Hello, savings account.

5. Energy Bill Hack ⚡

Australians are famous for complaining about power bills. Here’s how to shrink yours:

-

Compare providers on Energy Made Easy (it’s free).

-

Switch to cheaper rates (often saves $300–$500/year).

-

Turn off “standby mode” appliances—your TV isn’t watching you back.

-

Use fans instead of blasting the aircon all summer.

6. Selling Stuff You Don’t Use 🏠

That treadmill doubling as a clothes rack? Sell it. The PlayStation gathering dust? Sell it. Aussies love a bargain on Gumtree, Facebook Marketplace, or eBay.

Cash in your clutter—you could easily pocket $200–$1,000 fast.

7. Transport Tricks 🚗

Owning a car in Australia is expensive. Petrol, rego, insurance—it adds up.

Quick savings ideas:

-

Use fuel apps like PetrolSpy to find cheaper petrol nearby.

-

Consider public transport (cheaper, less stressful).

-

Carpool with mates or colleagues.

If you’re in Sydney, Opal’s weekly travel cap hack is a game-changer.

8. Cashbacks, Discounts & Rewards 🎁

Australia has loads of cashback sites and apps:

-

Cashrewards

-

ShopBack

-

Store loyalty programs (e.g., Coles Flybuys, Woolies Rewards).

Stack discounts with sales and cashback—you’ll feel like you’ve cracked the financial Matrix.

9. Negotiate Your Bills 📞

This is the most underrated money-saving move in Australia. Call your phone, internet, or insurance provider and say:

“Hey, I’m thinking of switching. What’s your best deal?”

You’ll be shocked how fast they suddenly find “special discounts.”

10. Automate Your Savings 💸

Set up a direct transfer from your everyday account to a high-interest savings account every payday. Out of sight, out of mind = money grows faster.

Even $50 a week = $2,600/year. Add interest, and it’s like your money is working a casual shift without complaining.

Quick Interactive Quiz: Are You a Saver or a Spender?

Tick your answers (be honest 😅):

-

Do you buy takeaway more than 3 times a week?

-

Yes → Spender

-

No → Saver

-

-

Do you know how many subscriptions you’re currently paying for?

-

Yes → Saver

-

No → Spender

-

-

Do you transfer money to savings automatically?

-

Yes → Saver

-

No → Spender

-

👉 Mostly “Saver”? Congrats—you’re already on track. Mostly “Spender”? No worries—start with two tips from this post and you’ll be saving fast.

FAQs About Saving Money Fast in Australia

Q: Can I save money fast if I’m living pay-to-pay?

A: Yes—start with small wins (like cutting subscriptions and meal prepping). Even $20–$50 a week adds up.

Q: What’s the fastest way to save $1,000 in Australia?

A: Sell unused items, cut eating out for a month, and switch energy/phone providers. Combine these and you could hit $1,000 quickly.

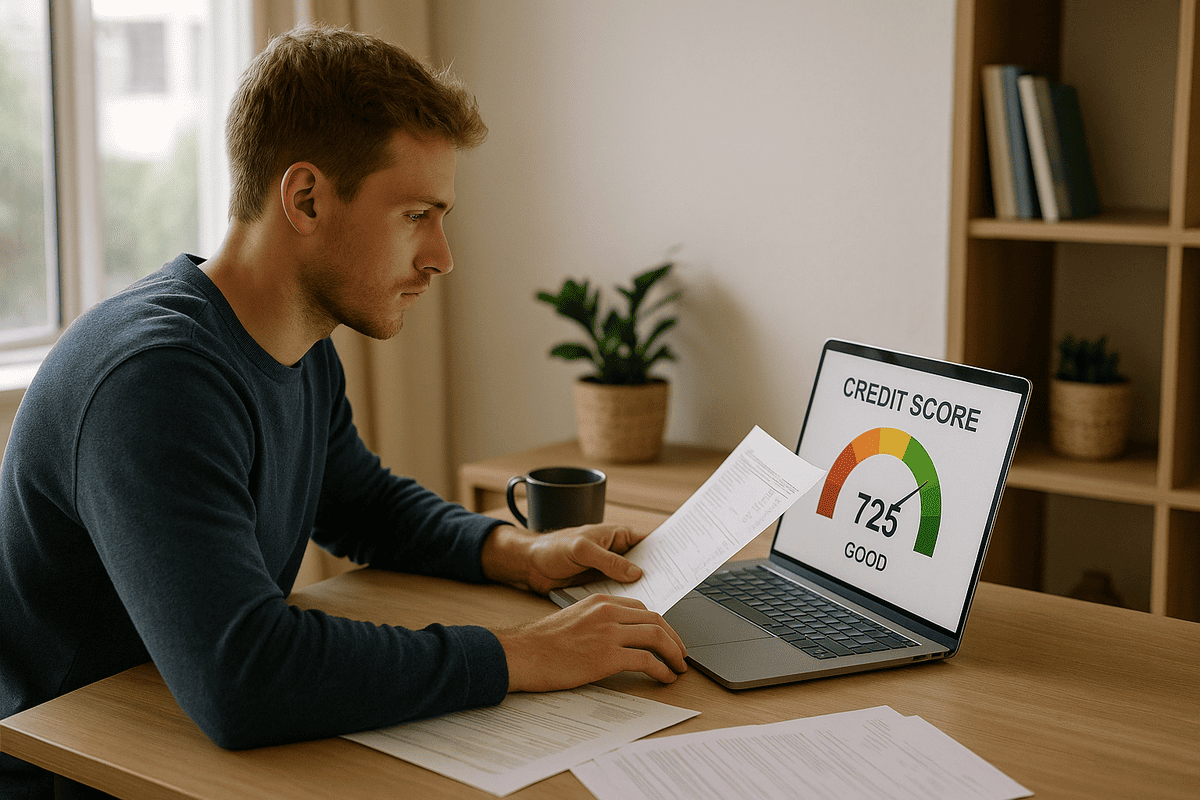

Q: Do budgeting apps actually help Aussies save?

A: Absolutely. Apps like Frollo, MoneyBrilliant, or PocketSmith track spending and keep you accountable.

Q: Should I give up coffee to save?

A: Only if you want to! There are plenty of other ways to save without sacrificing your sanity.

Conclusion: Start Small, Save Big

Learning how to save money fast in Australia isn’t about living like a monk—it’s about making smarter choices that snowball into real savings.

Start with one or two hacks, track your progress, and before you know it, you’ll have a decent chunk stashed away. Whether it’s for a rainy day, a new car, or that long-overdue trip to Europe, your future self will thank you.

So go on—cancel that extra streaming service, dust off that Gumtree account, and watch your savings pile up.